If you are looking for “How to calculate customs duty“

You are on the right page!

Here you will get the complete process to calculate customs duty using Ice:Gate

Hello, friends welcome to a fresh article from “IndianCustoms.Info”. Here in this article, I’m going to explain how to calculate customs duty for imported goods.

We also explain how to find the HS code of goods and the customs duty structure of the HS code.

There are lots of sites available for customs duty calculation.

But none of the sites are reliable, Because they are not updating details as per customs updates.

In my opinion, Ice:Gate is the best option for customs duty calculation. It is the official site of Indian Customs.

How To Calculate Customs Duty Using IceGate?

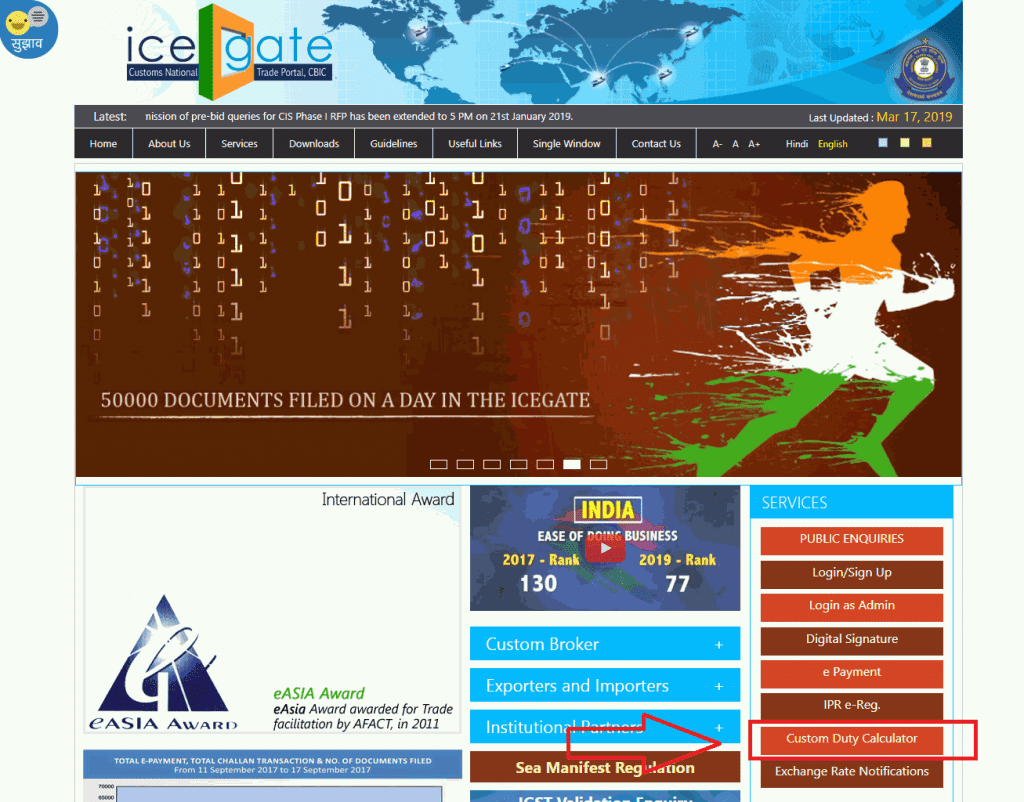

First, you need to visit the home page of IceGate to calculate customs duty.

On the home page, you can see an option “Customs Duty Calculator” Click on the same.

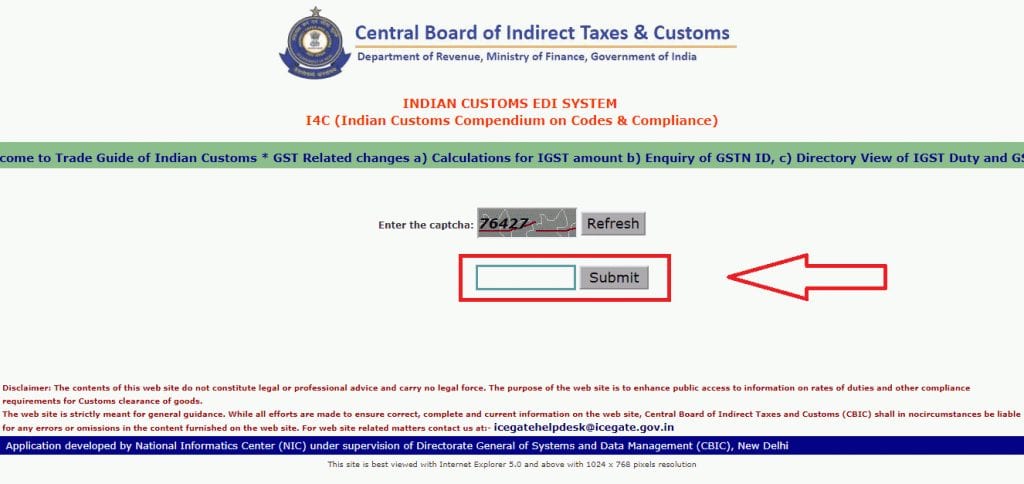

On the next page, you need to fill in a captcha and enter the “Submit” button.

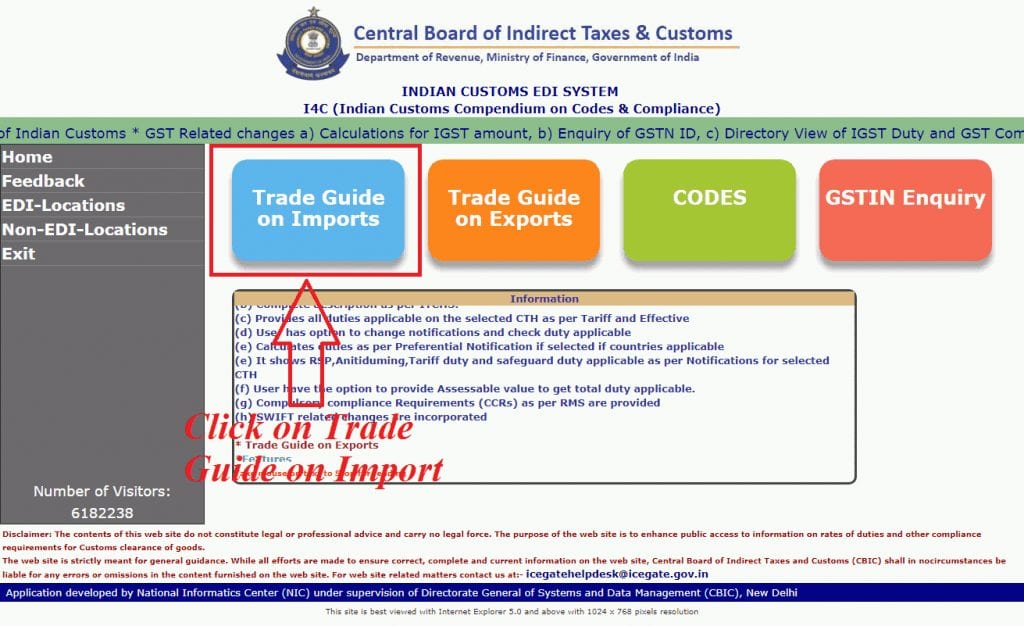

On this page, you can see 4 options:-

- Trade Guide On Import.

- Trade Guide On Export.

- Codes.

- GSTIN Enquiry.

You need to click on “Trade Guide On Import“

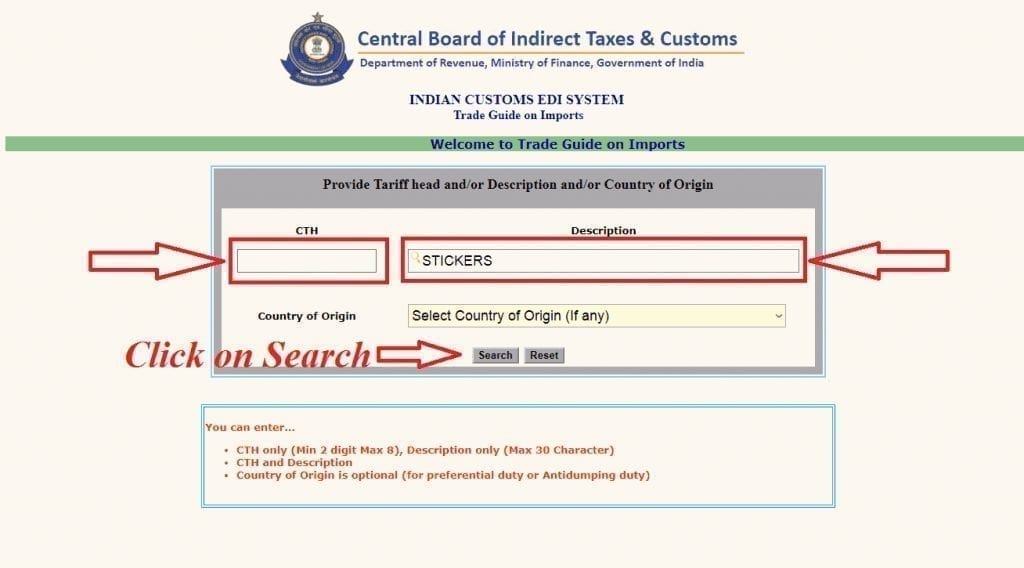

On this page, you can see two columns “CTH” and “Description”.

I know the CTH or HS code good then you can enter it in the “CTH Column” Or

Enter the description of goods in the “Description Column” and click on the search.

Here you can select the country of origin of goods, It will help you to identify the applicability of preferential duty or anti-dumping duty.

Here on this page, you can see the list of HS codes with descriptions.

You need to choose the correct HS code suitable for your imported goods.

For example:- Continued with HS code “39261099”.

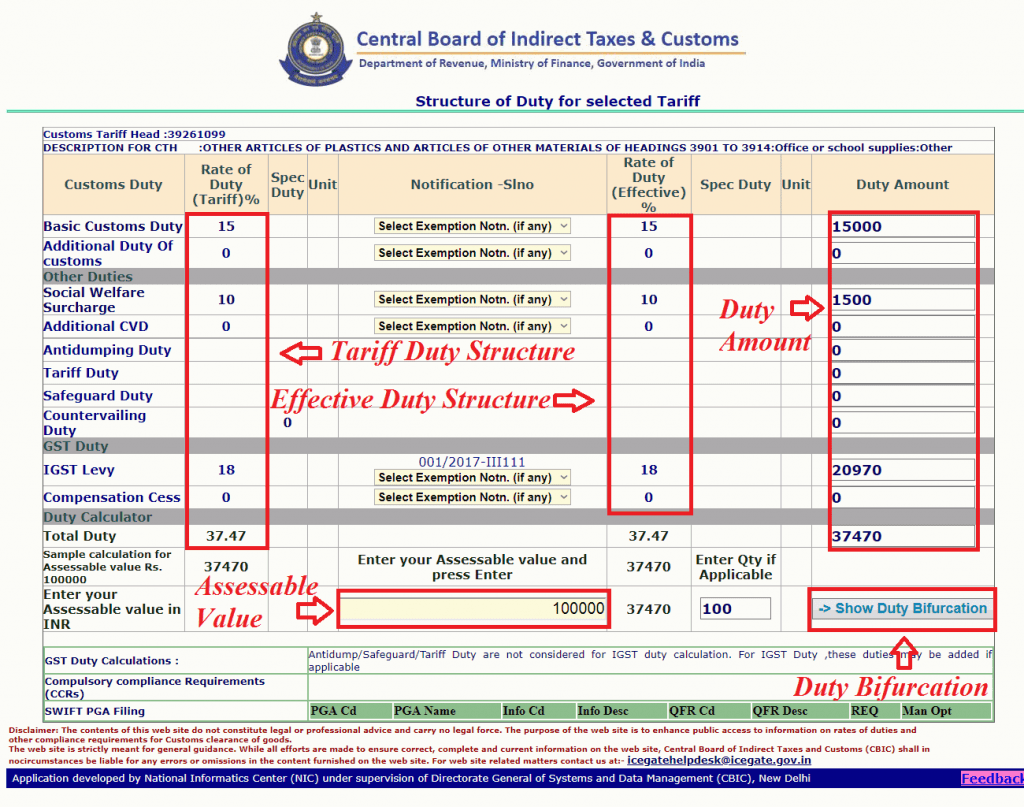

This is the main page, On this page, you will get complete details.

On the left side of this page, you can see the Basic Duty, Social Welfare Surcharge, and IGST in the percentage, It is the duty structure for the selected HS code.

In the center, you can see the effective duty structure.

And on the right side of this page, you can see the customs duty in rupees.

At the bottom, you can see an option to enter the assessable value.

You need to enter the assessable value of goods in the column “Assessable value” and click on Show duty bifurcation.

It will calculate customs duty automatically and show you the total customs duty along with the IGST amount.

I hope now you understand How To Calculate Customs Duty In India. Comment below if anyone has any suggestions or query regarding the customs duty calculation.

Admin (Indina Customs Info)

tell me till what amount of goods we need not pay custom duty

If you are importing any Goods in cargo mode you need to pay Customs duty, no matter what is the value of goods.

Is customs duty charged for mobile phones for personal and commercial purpose is differen

Customs duty is same for personal and commercial use.

Hi Fedex and DHL showing courier charge of ₹42,000 for a ₹25000. is it possible all customs duty included? or we need to pay customs duty extra? thanks.

Hi Fedex and DHL showing courier charge of ₹42,000 for products valued ₹25000 from china. is it possible all customs duty included? or we need to pay customs duty extra? thanks.

Hi Abdul,

It can possible if you accept the charges before handover the goods.

I WANT TO BRING A UHD TV LG, IT COST ME 360 USD, I’M TRAVELLING FROM DJIBOUTI TO MUMBAI, SO HOW MUCH CUSTOM DUTY I HAVE TO PAY FOR IT AT THE AIRPORT .

THANKS

Hi AshwiniSingh Verma,

Customs duty for Baggages is decided at the port by customs officer after examining goods.

Hi

What will be the custom Duty for White Port Land Cement and Anti Dumping Duty,

Hi Nirmal,

Please follow the article instruction to find the duty of any commodity.

Hi. Thanks for the above info. I still have some doubts. I tried the calculator, where in I’m ordering a musical instrument (Kalimba) from a US website and it’s worth 5700 including shipping. CTH, 92071000. Once I enter the assessable amount, in the Duty calculator section right in front of total duty, I see the duty amount as 1026. Does that mean, that’s all the charges I will have to pay?

Hi Shubham,

Please use the Duty calculator as the instruction provided in the article.

Hi indiancustoms.info webmaster, Your posts are always a great source of knowledge.